ZERO BiK

Why full-electric vehicles make sense for fleets and drivers.

Full-electric vehicles, no matter when they were registered, are now subject to a 0% BiK rate for the 2020/21 tax year – previously 16%.

From 2021/22, this will increase to 1% and rates would then be frozen at 2% from 2022/23 up to 2024/25. There’s no doubt that with these rates, choosing an EV could save company drivers thousands over diesel-powered alternatives.

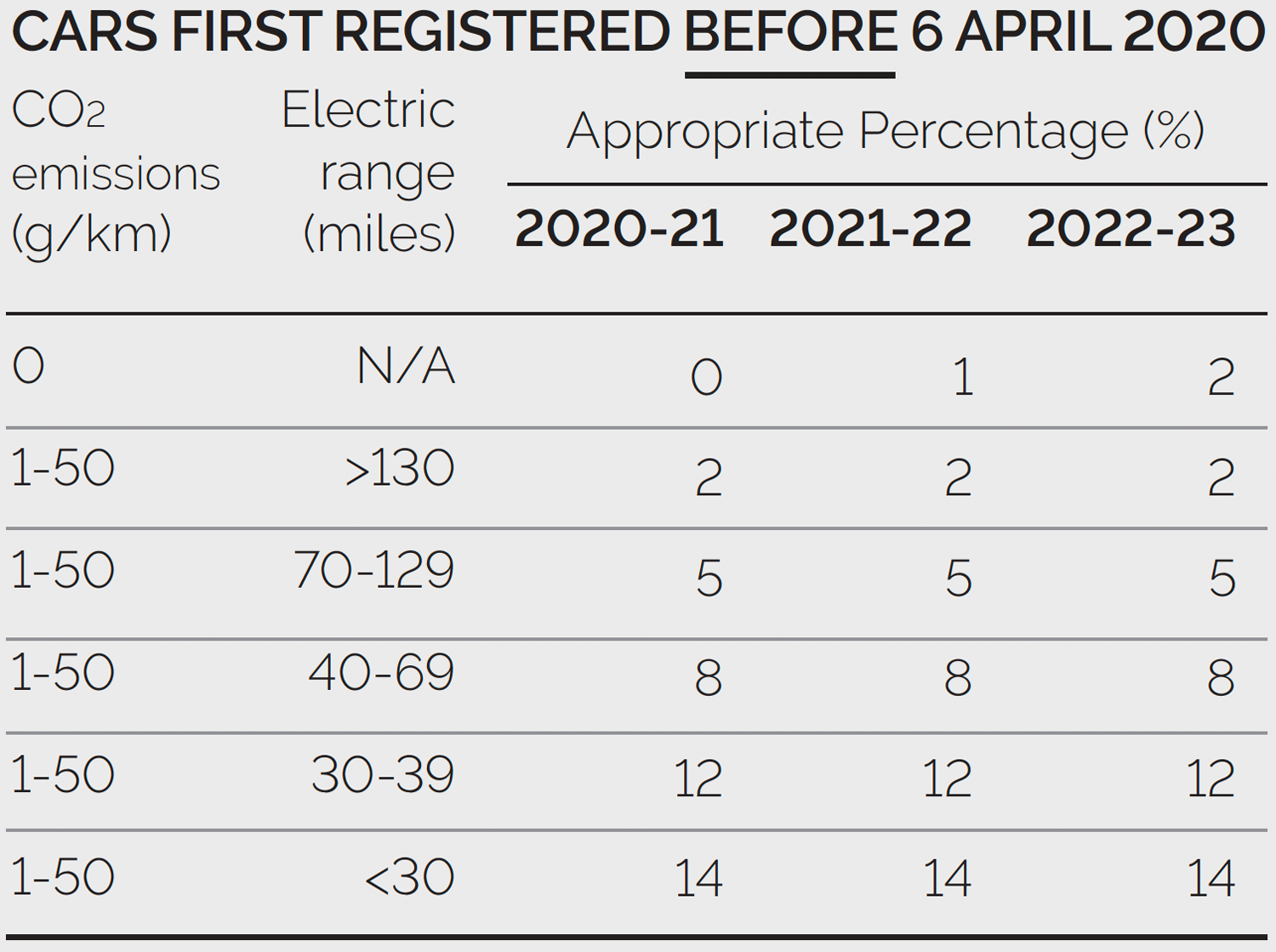

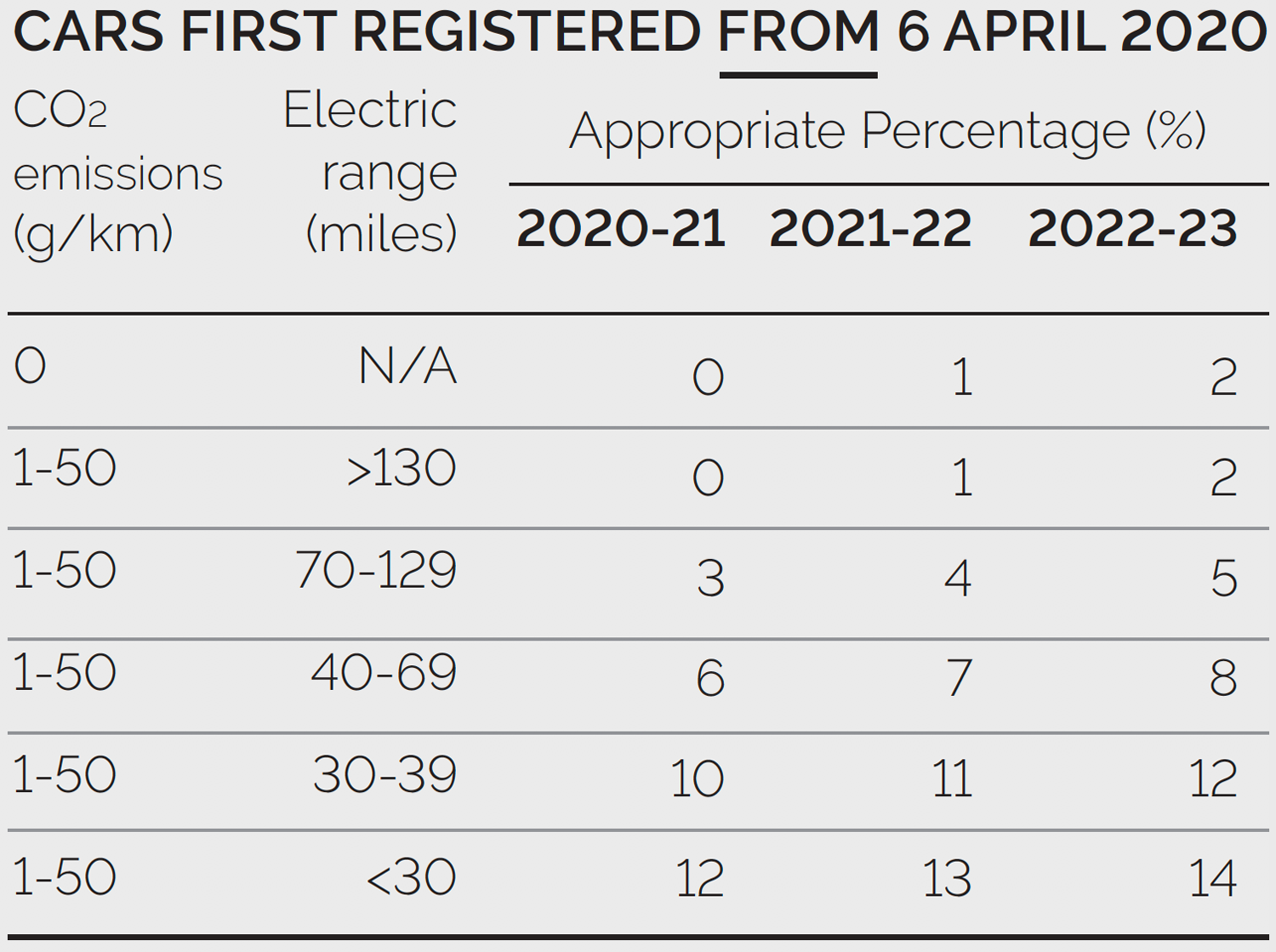

The Worldwide Harmonised Light Vehicle Test Procedure (WLTP) came into force in April 2020, which explains the difference in rates between cars first registered before 6 April 2020 and those first registered from 6 April 2020. The Government’s £3,000 plug-in car grant will carry on to the 2022/23 tax year – and £500 million has been pledged over the next five years to support the rollout of rapid charge points for EVs; the idea being that EV drivers will never be more than 30 miles from a rapid charging station. A Rapid Charging Fund is also included in this legislation, which will help businesses with the cost of connecting fast charge points to the grid.

BiK RATES FOR EVs

DEFINITIONS OF ZERO AND LOW-EMISSION VEHICLES

EVs: These are vehicles that run solely on electric power, usually a rechargeable battery, rather than an internal combustion engine. They produce zero emissions and are therefore eligible for the 0% BiK rate in 2020/21 and BiK discounts beyond. HEVs: HEV means Hybrid Electric Vehicle, powered by an internal combustion engine (ICE) that is assisted by an electric motor, with a small rechargeable battery. In turn, this is charged by regenerative braking or the petrol engine. HEVs switch between the two power sources but can also be driven in electric-only mode for short distances.

PHEVs: Plug-in hybrid vehicles typically work in a similar way to HEVs – being equipped with both an internal combustion engine and an electric motor. The key difference is that a PHEV has a plug socket so its battery can be charged via an external power source and they tend to have much larger battery packs. As such, a PHEV has a longer electric-only range and tends to offer greater efficiency than an HEV.

FUEL BENEFITS

Where fuel is provided by an employer for private mileage, there is a charge to pay by applying the appropriate percentage to the car fuel benefit charge multiplier, which is £24,500 for the 2020/21 tax year. This could prove to be a very expensive charge, unless the employee’s car is a low CO2 model.

The good news is that if a full EV is chosen, electricity is not regarded as a fuel for car fuel benefit purposes and as such if you charge at work, there is no benefit charge.

EV-driving employees, now also benefit from the Advisory Electricity Rate (AER) of 4 pence per mile.